Today I've got a special treat---a conversation with Briana Dodson, Community Strategist for the Penny Hoarder Hoop.la community. It's always so great to hear insights from people who are "in the trenches," and Briana is growing something really special.

Tell us about The Penny Hoarder and how it came to be. What’s your mission?

The Penny Hoarder was founded on the idea of improving the lives of everyday people by helping them spend less time worrying about their finances and more time enjoying their lives. The topic "personal finance" shouldn't be taboo, so we aim to start more conversations with our readers while encouraging them to embrace their individual financial journey. “There is a tomorrow worth saving for,” as one of our community members has said.

Our mission is to make personal finance less intimidating and accessible. We do this by providing inspiration and actionable advice to millions of readers on how to make, save and manage money.

We hear our members tell us all the time that they need step-by-step guides for what to do with their money so we’ll write in-depth pieces on various personal finance topics. One recent one we did was on how to save money. We broke down everything from how to develop savings goals to effective budgeting methods to establishing a budget-conscious lifestyle. Whether on The Penny Hoarder website or in our community, our goal is to explain those topics further, sharing as much information as we can in the most fun, inspiring way possible.

What type of audience are you serving?

People from all walks of life engage with our content — from the single mom who is trying to figure out how to bring in an extra $1,000 each month to the young professional strategizing on how to pay off student loan debt to the couple with no kids who wants to retire early. Our audience is made up of motivated individuals who want to do more with their money.

You originally had a Facebook Group as your primary community space. What led you to look for an alternative solution?

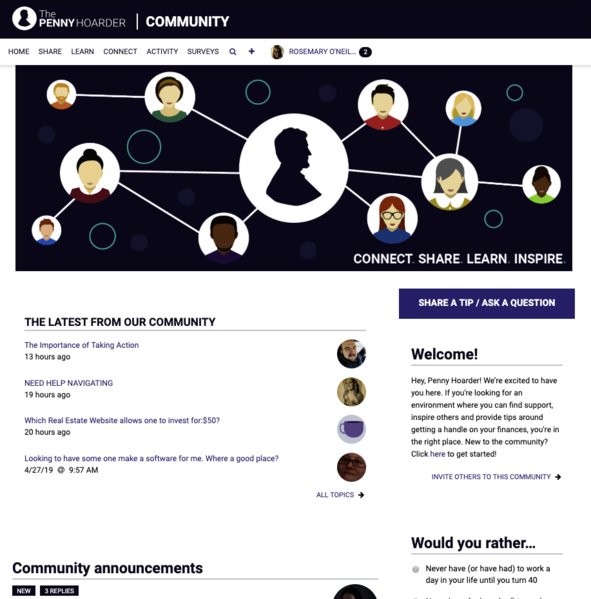

Facebook was a great place to start building a community — most of our community members were already congregating there, and it was a place we could easily share our website content because conversation naturally happened. But with that, and with any social platform, there were limitations including privacy and not being able to own all of the data. When you're discussing personal finance, privacy and safety are top priority. We wanted to provide a more gated, exclusive experience for our members.

What attracted you to Hoop.la?

The customization capabilities and the robust set of features that the platform provides were definitely a few of the selling points. We knew this was something we wanted to be elbows deep in, to be really developing each aspect of the community. Hoop.la allows us to think outside of the box and do that.

Now that you’ve officially launched, what kind of traction are you getting? Can you share any numbers or stats?

Within the first three months, we've grown to almost 3,000 members — and they're very active! Out of our total members, 69.3% are active (on average) since the launch. And member feedback has been really motivating! They enjoy the environment, and it's been helpful to them thus far.

What has been the most surprising thing since your transition?

Lots of our members in the past were pretty adamant about getting away from negativity. Because personal finance is just that — personal — it's critical that our members feel supported and safe. And I can proudly say that I have yet to moderate one negative comment, which is certainly amazing. It's also nice to see members really stepping up and taking the reins in the community — it's evident that members want to be here.

You’ve been having actual interviews with many of your members. Would you recommend that strategy to other community admins? If so, how was that helpful? Any tips for doing it right?

There's nothing better than getting to talk directly to the members that make you what you are! Most people that we talked to actually let us know that no other company has provided that experience. You get to really learn about what people's needs are and who they are beyond just another member. It gives our members a sense of purpose and lets them know they are valued. We're building a community for them. Get to know what motivates them, what keeps them from reaching their goals, what they like and don't like. Look beyond surface level questions like "What can we do?" and focus more on what they actually do.

How are you spreading the word internally about the new community? Do you have any recommendations for other community managers who are trying to get other departments to support a community effort?

Talk about it! The biggest challenge with getting other departments on board is not sharing what the community is and why it exists. It's an open-door policy — we welcome any and all questions. It's important to have conversations around how the community will impact other departments as well. When we first launched, we held an internal contest for community sign-ups. It was a great way for people to have a hand in growing the community. One last thing I'd mention is to share feedback with your company. We love hearing and seeing what our members are saying about the brand — and the community is a great place to get a lot of that!

What’s your ultimate dream for the The Penny Hoarder community?

Personal finance is something that affects every single person. And being able to create a safe, welcoming space for members to feel absolutely themselves and to seek advice and help others is a dream already. On a larger scale, I'd love to be able to make talking about personal finance a norm and to meet some of our members face-to-face.

Thank you very much Briana, we look forward to seeing this new community thrive (and brushing up on our financial skills)!

Comments (0)